More on DeFi

Going Further Down the Rabbit Hole

Hello Anons!

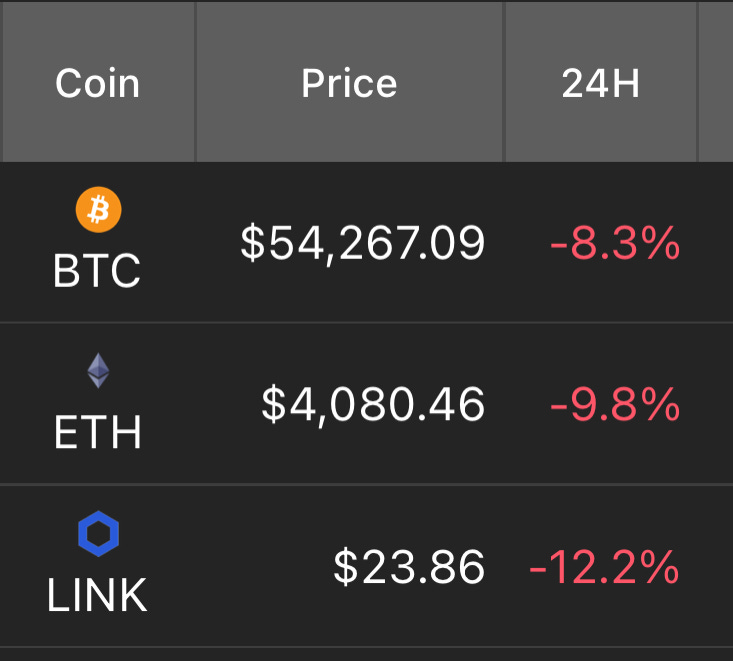

The holidays are officially upon us and I thought a Black Friday edition would be the perfect way to start off the long weekend while the market is having a sale of its own today.

One of the recent newsletters written on here covered Centralized Exchanges and Decentralized Exchanges. This week is a follow up to that issue and another step forward for all of you in DeFi.

Anyone who is interested in crypto needs to be aware of everything that is happening in the space, at all times. Lately in the US we’ve been hearing more from politicians who are negative and “concerned” with the rise of crypto → we all know it’s lobbying for the digital dollar/US CBDC.

The Digital Dollar Project is a partnership between Accenture & the Digital Dollar Foundation to advance the USD forward. Accenture’s CBDC work includes engagements with the Bank of Canada, the Monetary Authority of Singapore, the European Central Bank, and Sweden’s Riksbank.

The most efficient way to launch a CBDC today would be through smart phones. They would enable access to a CBDC with enhanced capabilities for a digital wallet to store other information about you and turn into more of a personalized all encompassing personal information device. Accenture’s Digital Dollar whitepaper mentions numerous times the potential/hypothetical limitation of illegal or illicit activities with a digital dollar. I think much of this leads to “potential” restrictions and limitations of public access. Much like the Chinese CBDC and their digital wallet merging with their social credit system.

Truthfully, not all of it is negative. There are a lot of people who are unbanked and need access to things like this. This will be a seismic innovation whether you see it in a positive or negative frame. Still very important to remain knowledgeable of.

Quick Review on DeFi

This brings us to the first part of this issue, the ongoing developments in DeFi. Again, Decentralized Finance (DeFi) is the ecosystem of financial services that take place online and are built on globally distributed networks and do not contain any centralized intermediaries. No longer do you have to rely on the archaic, inefficient, and ineffective incumbents in the current financial system.

We know from the last DeFi newsletter that Ethereum is the “world’s programmable blockchain” that enables the production of Dapps (Decentralized Applications). It is no surprise that currently *most* DeFi applications and projects are ran on Ethereum. Ethereum Dapps turns all of this into “programmable money”.

In DeFi you are given the ability to generate a yield on your own assets as the sole bearer. You can lend out money, borrow against your holdings, trade your assets, stake assets, swap assets, provide liquidity, and more. Thereby actively participating in a more elite global financial network. This is the biggest change and the most revolutionary change to come to finance in our lifetimes. This means all of us can fully automate our digital assets and turn them into something constructive. This is open to everyone, no restrictions and is “trustless”. All you need is internet access.

To understand the size and opportunity here I’d like to draw on a similar comparison that @BowTiedBull has used before. Market estimates project that by the end of 2021, the financial services market is likely to reach $22.5 trillion, growing at a rate of 9.9% from the previous year. With global GDP expected to reach $93 trillion in the same year, that would mean that financial services comprise about 24% of the world's economy. (Investopedia)

As of 2021, the size of the bond market (total debt outstanding) is estimated to be at $119 trillion worldwide and $46 trillion for the US market, according to Securities Industry and Financial Markets Association (SIFMA).

Currently at this very moment of writing, the DeFi total market cap is ~ $155 billion, or 0.7% of the global financial services industry. What do you think happens when people realize the superiority of this and start becoming more active in the space? What happens after everyone begins to catch on to the issues with the fixed income market? People going negative on their “investment” from inflation and fees as they lose over the long term for opting for something “safe”. What about all the people in the world with a bank account receiving microscopic 0.05% yields from a savings account vs the yields in DeFi?

Eventually more people and businesses are going to prefer to receive BTC & ETH as payment rather than worthless fiat currency being inflated away. Already there are athletes being paid in digital assets like ETH or BTC, and more and more companies accepting it as payment now. More importantly, countries like El Salvador are adopting BTC as a national currency.

Christmas came early for the citizens of MIA as they will begin to receive a Bitcoin yield for being a local resident. “The City of Miami will soon give out a “bitcoin yield” from the staking of its cryptocurrency to its citizens, Miami Mayor Francis Suarez announced on CoinDesk TV Thursday morning.

“We’re going to be the first city in America to give a bitcoin yield as a dividend directly to its residents,” Suarez said.

Now, imagine the implications of this on a large scale. Cities, states, and countries all around the world will start doing things like this to attract more residents, to remain competitive.

All these changes are occurring faster than anyone could predict even just one year ago. More and more people are starting to realize the advantages here. You, and anyone in the world with an internet connection can take part in the monumental shifts occurring and stay ahead of the curve. (You already are if you’re reading this by the way)

The foundation of Decentralized Finance is built off of blockchain, cryptography, smart contracts, and decentralization.

Blockchain is technology that collects information in sets or *blocks* that are then connected cryptographically. The result is that nothing be changed or corrupted. The information cannot be changed or modified making it → immutable.

Think of it as a public record of data stored in chronological order. The blockchain is shared between all users. As new data comes in it is entered into a fresh block. Once the block is filled with data it is chained onto the previous block.

Cryptography is the use of written code to secure communication between two people in the presence of third parties. It secures information (data transfers) and simultaneously protects it in from “bad actors”. For you, that is securing your wallet, assets, and transactions.

Smart Contract: a self-executing contract with the terms of the contract written into the code. All the information in the contract resides at a specified address for their specified purposes (bets, swaps, acquisitions.). It's a collection of code (its functions) and data that resides at any specific address on the Ethereum blockchain.

“When deployed to a blockchain, a smart contract is a set of instructions that can be executed without intervention from third parties. The code of a smart contract determines how it responds to input, just like the code of any other computer program.” (chain.link)

Think of smart contracts as a type of account. This means they have a balance and they can send transactions over the network. However, they're not controlled by a user, instead they are deployed to the network and run as programmed.

Decentralization: meaning not in one *central* place. Just like in Bitcoin and Ethereum where you have a wide distribution of all the node operators and miners thus you have a widely decentralized network. The operations are distributed globally without a central means of power or authority.

We are early in DeFi, which means that not everything is fully decentralized at this time. Things don’t start off as fully decentralized right away. It takes time. DeFi is constantly growing and as the new projects launch they will start off more centralized.

When Bitcoin and Ethereum initially had their launches, the BTC network in 2009 and the ETH network in 2015 started off on a number of computers before the networks expanded and grew. So, it is important to remember that some of these will be more centralized early on. I don’t want this to scare new readers. We all know these things take time to grow. There will be more centralized or partially centralized projects at times when they’re more nascent. Most of it right now sits around the partially decentralized/mostly decentralized end.

DeFi Market

The current market of DeFi is currently sitting ~ $156 billion in market cap (in USD terms) with a total trading volume of ~ $13,400,000,000 in the last 24 hours. The last 90 days of the DeFi market have been interesting. The total market for DeFi recorded a new ATH of ~ $173 Billion in market cap. ETH currently still hovering around $0.5T market cap. All in all, everything is trending upward recording nearly 27% growth in DeFi over the last 3 months.

(CoinGecko)

The biggest three crypto assets in DeFi by market cap at the moment are LUNA, LINK, and UNI.

(CoinGecko)

Luna: This is the currency used on the Terra platform. You can find their official page and more information about them here → terra.money .

Terra is a public blockchain protocol that contains a variety of algorithmic decentralized stablecoins. It provides the user the ability to instantaneously trade, save, exchange Terra stablecoins on it. Terra and Luna are the two primary tokens.

“The foundation of an ecosystem that brings DeFi to the masses”.

Terra are stablecoins that track things like fiat currencies. Ex: TerraUSD (UST)

LUNA has three core functions: 1) mine Terra transactions through staking, 2) ensure price stability of Terra stablecoins and 3) incentives for the platform’s blockchain validators. Currently we are sitting at a circulating supply of 400 Million LUNA coins & a total supply of 876 Million. (Source: CoinGecko)

LUNA is mainly used for → Governance and Mining

It recently hit it’s ATH price of $54.77 (Nov 7)

Link: In one sentence, Chainlink is a platform that brings real world data onto blockchain networks. Think of it as the blockchain that connects and bridges data together. It is the fastest way to retrieve data feeds from the “real world”. This is very pertinent and crucial to defi → smart contracts. They allow the

Their DONs (Decentralized Oracle Networks) provide decentralized services such as Price Feeds, Proof of Reserve, Verifiable Randomness, Keepers, and the ability to connect to any web API. Oracles are the way to connect blockchains to the real world. The oracle validates and verifies data to ensure that it is fully tamper proof, in a decentralized manner → DONs.

LINK is the native currency of the Chainlink ecosystem. You can also see that out of the 3 listed tokens this one has the highest 24 hr trading volume.

This token is used for node payments and collateral. Working with Chainlink Oracles outside of data feeds follows the request and receive cycle of working with Chainlink.

The LINK token is specifically designed to work with oracles and is based on the upgraded ERC-677 token, which is backwards compatible with ERC-20. (Ethereum.org). Think of ERC 20 as the “Ethereum token standard”.

General Breakdown - An ERC-677 token: Allows tokens to be transferred to contracts and have the contract *trigger logic* for how to respond to receiving the tokens within a single transaction. This adds a new function to ERC20 token contracts, which can be called to “initiate a transfer” of tokens to a contract and then call the contract with the additional data provided. Once the token is transferred, the token contract calls the receiving contract's function and triggers an “event” (GitHub)

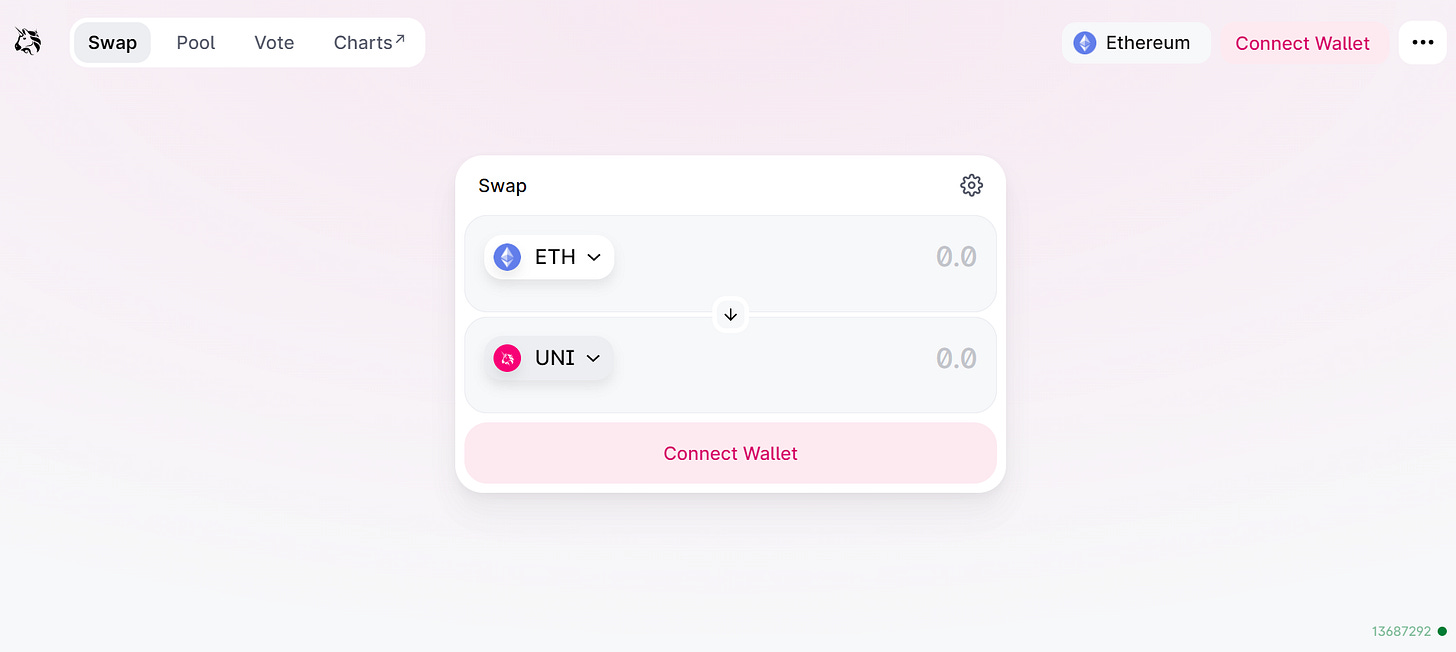

Uni: This is the governance token on the Uniswap platform/protocol. This is where you can go to swap other ERC-20 tokens. The Uniswap Protocol is an open-source protocol for providing liquidity and trading ERC20 tokens on Ethereum.

It eliminates trusted intermediaries and unnecessary forms of rent extraction, allowing for safe, accessible, and efficient exchange activity. The protocol is non-upgradable and designed to be censorship resistant. (Uniswap).

To swap tokens, provide liquidity, or vote on governance proposals you go onto the platform at uniswap.org and connect your MetaMask wallet.

Next a list of wallets will appear on your screen and you will select MetaMask to connect your wallet which will bring you to this screen.

You will only type in your metamask password to connect your MetaMask to UniSwap.

This will connect your *wallet* to the protocol which will enable you to *use* your funds (ETH, LINK, UNI, etc.). After doing so you will be officially putting your digital assets to use and make them productive.

Luna, Link, and Uni are the 3 largest and are measured by market capitalization, as you can see they have large levels of 24hr trading volume → the total amount of buying and selling to occur over the last 24 hrs.

There are currently 26 as of this writing that are currently sitting above $1B in market capitalization and continue to grow. Conservatively I expect the growth of DeFi over the next 12-18 months to be ~10X putting it easily over $1T market cap.

The biggest DEXs as of this writing are currently Uniswap, Pancakeswap, and Trader Joe

These are the 3 most widely used DEXs right now, and a few good places where you can use your ETH to participate in DeFi in addition to Uniswap.

Learning DeFi is going to be crucial for you. DeFi is easily one of the biggest opportunities in the entire crypto space. BowTiedBull puts it perfectly in this statement here → “DeFi is effectively replacing Wall St and traditional finance functions with code.” You are embarking on an opportunity to become your own bank, and everyone around the world with an internet connection now has a chance to work with people all around the globe, to borrow from and/or lend to them, and more. This involves investments, fundraising for commercial or private operations, all without any restrictions and all secured by code.

Think of all the efficiency this provides to the existing financial infrastructure and how much opportunity there is out there for the unbanked. People now are given the option to leverage new technologies and participate in things they care about around other parts of the world in a decentralized format.

Conclusion

Thank you for reading! I look forward to reading your questions and comments. Hope you all had a fun and safe Thanksgiving.

Crypto and Boomers and CBDC Watch are still growing consistently! I can’t thank you all enough for the support. I look forward to writing these for years to come!

Disclosure: Not legal or financial advice

Question re buying SOL and AVAX for 2022 opportunities. Having been only stacking big 3 since spring and still learning. Suggestion on how much is needed of each to participate? Is it just exposure or a minimum to really play? Thanks and learning so much from your guide!

Fantastic write up. Thank you!