Hello, Anons.

It’s been requested that I write a substack covering Decentralized Exchanges. Since this is Crypto for Boomers this issue is going to cover both Centralized and Decentralized exchanges. It is important that you know and understand the differences between DEXs and CEXs as we continue moving forward on the journey of simplifying crypto.

In the future if any of you want something covered, leave it in the comments! If it’s something quick I’ll answer it for you. If it makes for a good post, I’ll cover it in a future newsletter. For this one you can thank Ty Dolla Sign for requesting this in the comments on the last post.

Before diving in, I wanted to take a moment to thank all the readers. There has been consistent and substantial growth in this substack. I’m honored and thrilled to be writing for you and helping you learn about crypto. My objective for this newsletter is to first help you “get off of zero” before we cover things more in depth.

Bitcoin and Ethereum offer you a whole new way to deal with money. They make you the sole owner of your assets. Meaning that you don’t have to conduct your financial transactions through rent seekers as Bitcoin and Ethereum functions make middle men completely obsolete. Bitcoin makes you your own bank, and Ethereum does that and additionally gives you the ability to lend out and earn yield on your crypto assets.

Crypto creates more efficiency where everything moves faster on a 24/7 basis, you have no middle men, and as you embrace new technology you learn how you can gain from the global economy.

Anyone looking to acquire crypto assets should already have a hardware wallet by now. If you don’t, again, please, get one as soon as possible. This should be your number one priority if you own any BTC or ETH.

Links for Ledger, Trezor, and CoinKite are listed here:

Ledger → Ledger Nano X

Trezor → Trezor Model T

ColdCard → (Bitcoin only). Highly secure and very technical. This should be used by people who are already familiar with hardware wallets. I recommend KISB Guide Bundle or Uncle Jim’s Bundle from CoinKite.

Note: You should have multiple wallets.

Centralized Exchanges

The most common place retail will buy and sell cryptocurrencies. They are based out of single 3rd parties/middle men, such as Coinbase or Binance. A centralized exchange (CEX) is a *central* place for retail buyers to easily exchange fiat (USD) for crypto all in one place online. That is the primary objective of all CEXs, to give buyers an option to directly exchange dollars → crypto, crypto → crypto, collect fees, set buying and selling limits, KYC their customers, and have an experience that isn’t complex.

The concept of buying crypto from a centralized entity can be a confusing idea for some. People new to crypto hear “centralized exchange” and try to understand how that works when they know cryptocurrencies, like Bitcoin, are *decentralized* and can be purchased on centralized exchanges. The word *centralized* in CEX is a reference to the *exchange*, not the assets trading on the exchange. It is a direct reference to the operation of the exchange.

I believe it’s safe to say that everyone reading this has heard of Coinbase ($COIN). This is one leading example of a CEX and currently the most popular place to buy and sell cryptocurrencies in the US. $COIN went public earlier this year, and is listed on the NASDAQ, just closed at $319.42 as of 10/29.

In the image above you can see this is where Coinbase has the crypto assets listed that are available for buying & selling. This is what it looks like on your laptop when using Coinbase. The interface will look a little different if you’re on your phone, however, both are equally easy and simple to use.

(Note: Not *every* crypto asset is listed on here.)

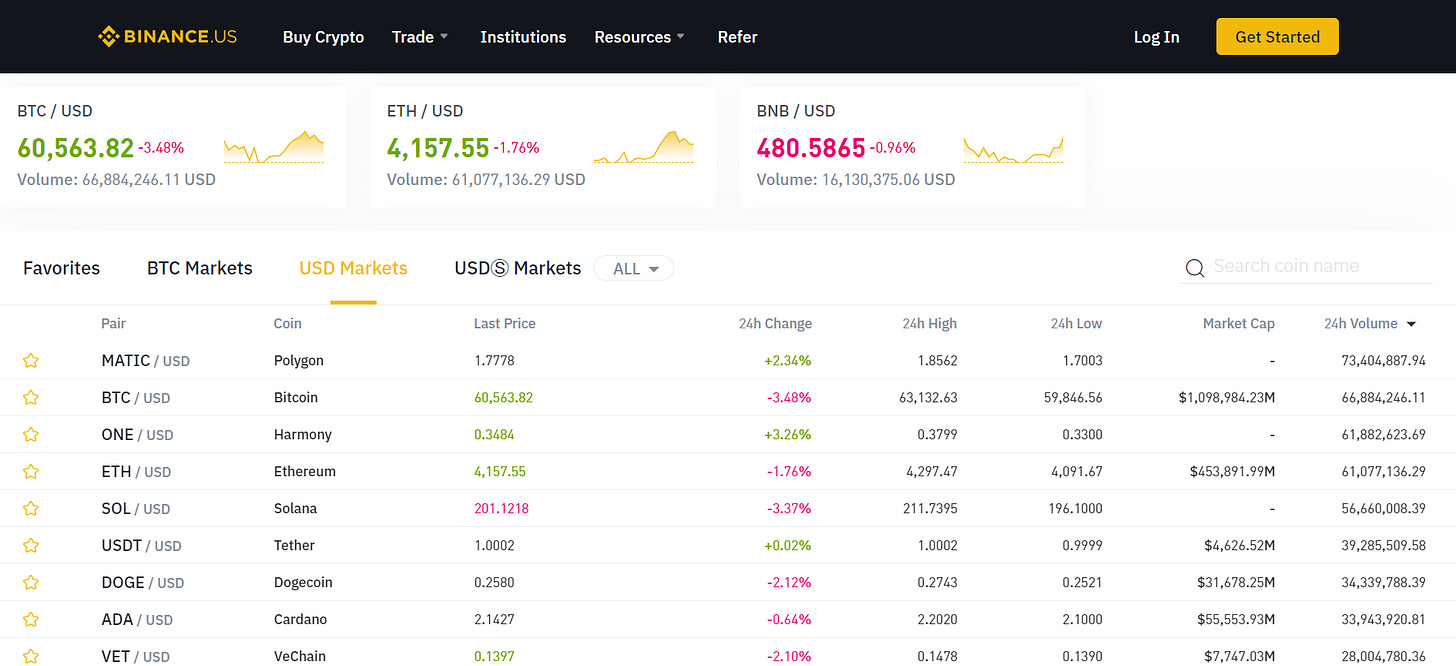

Even though Coinbase the number one centralized exchange here in the US by daily trading volume, it isn’t without any competition. Currently it’s biggest competitor is Binance who has the highest daily trading volume globally.

(USA citizens can only use Binance.US)

The two are a little different but achieve the same purpose. Both aim to offer retail a self-directive way to purchase crypto assets in one place. They’re designed for a simple user-friendly experience on the exchange. They provide features that traditional brokerages do for your equity/stock purchases. Thereby making it a relatable experience to purchase crypto.

Comparing Coinbase & Binance

Any US citizen has access to these, and to provide more insight, below is a chart displaying their respective differences.

(Disclosure: There are currently ongoing regulatory concerns with Binance at the moment in the US.

→ Not Your Keys, Not Your Coins.

Buying and using a hardware wallet will make you the sole owner of the assets.)

How to Use a Centralized Exchange

First step is to create an account. This is where you enter your identification information and bank account information. This is called “KYC”, Know Your Customer.

In order to trade on a centralized exchange, you need to create an account and deposit funds in either fiat (USD) or cryptocurrency. You can always transfer funds from your hardware wallet/hot wallet and send them to the exchange via the crypto address on the exchange.

It’s worthy to note that CEXs will always have limits. Limits on how much you can buy and withdraw daily and weekly. Once the funds land on the exchange, your funds will update on the account balance and will be available for purchasing crypto.

After any crypto you transfer to the exchange, or purchase, you will also be able to swap one crypto asset for another.

After your funds have cleared on the exchange and have officially settled you will be able to withdraw and deposit into your hardware wallet.

Overall there are both pros and cons to consider. By listing these next to each other we can easily see what we need to consider at once.

Pros & Cons of CEXs

Pros

Suitable for anyone: advanced UI/UX

High liquidity

Trading Volumes

Variety of trading tools

Fiat deposits

Cons

Compromised security

Compromised anonymity (KYC)

Strict regulations, dependency on the state

Not your Keys, Not your Coins

It is important to pay attention to the cons. At the end of the day leaving your coins on the exchange will leave them at risk to hackers, changes of exchange limits of purchases and withdrawals, and will continue to be subjected to their fees. In my opinion only using a CEX is the opposing the idea and nature of crypto and compromises the main idea.

Decentralized Exchanges

In its fundamental nature, Decentralized Finance (DeFi) is the replacement of financial intermediaries by decentralized applications (Dapps). It is an alternative to the current financial system → DeFi is replacing the “legacy” financial system through smart contracts on the blockchain → through *code*. All you need is an Ethereum address to participate.

A Decentralized Exchange is a type of dapp that lets you swap tokens with peers on the network. You need ether to use one (to pay transactions fees) but they are not subject to geographical restrictions like centralized exchanges – anyone can participate.

A decentralized application (dapp) is an application built on a decentralized network that combines a smart contract and a frontend user interface. On Ethereum, smart contracts are accessible and transparent – like open APIs – so your dapp can even include a smart contract that someone else has written. (Ethereum.org)

The legacy financial system’s products are not open source and transparent like they are in DeFi. We know this because DeFi is ran on blockchain technology and leaves it open for anyone to use. We’re not sure of what their processes are behind closed doors.

Code programmers who are writing smart contracts provide the production of Dapps. We know from a past newsletter that Ethereum is the “world’s programmable blockchain” that enables the production of these Dapps. It is no surprise that currently *most* DeFi applications and projects are ran on Ethereum. Ethereum Dapps turns all of this into “programmable money”.

Smart Contract: a self-executing contract with the *terms* of the contract being written directly into code. All of the information in the contract resides at a specified address for specified purposes (bets, purchases, etc.). It's a collection of code (its functions) and data that resides at a specific address on the Ethereum blockchain.

Think of smart contracts as a type of account. This means they have a balance and they can send transactions over the network. However they're not controlled by a user, instead they are deployed to the network and run as programmed.

These Dapps are products and services that do the same things you would in the traditional financial system.

They let you: save, borrow, earn, trade, and more all while being completely open and free to use since it is ran on *open source technology*. It is built for the internet, which is all you need to participate in DeFi.

A DEX allows people to exchange assets without giving up control of their keys. DEXs do not have a centralized body providing liquidity, they use liquidity pools.

Liquidity Pool: A liquidity pool is a large decentralized pool of assets acts that acts as the market maker instead of a single person, company or institution.

This works by using smart contracts to regulate a pairings of assets. Owners of assets transfer their assets to a protocol and receive Liquidity Protocol or "LP tokens” of that protocol in return.

When someone uses a DEX to exchange their cryptocurrency for another, they pay a fee of approximately 0.3%.

The Bottom Line

DEXs are extremely effective and efficient. They offer a lot more to crypto than CEXs and it’s not even close. DEXs are more open, require no KYC, enable better products and offer extremely high functionality and top notch security. It is highly secure because DEXs have code that backs their security, meaning that third parties don’t hold your funds for you, and are again obsolete. The code safeguards your funds for you. The smart contract is placed on the blockchain and is executed based the conditions in the contract.

“Smart contracts work on the “if this, then that” principle. Whenever a specific condition is fulfilled, the smart contract will carry out the operation as programmed.” Source

CEXs will be around for a long time, currently still have still offer new retail traders an easy way to get started. However, in the long run, the DEX will continue to take on more daily trading volume, eventually taking the majority of the market share as they’re more open to more people. All that someone needs is an Ethereum address to have access, meaning, all you need is internet access.

Top Exchanges by 24hr Trading Volume

CEXs

DEXs

Some popular DEXs are listed below with links attached.

Uniswap (←Link)

Curve (←Link)

SUSHI (←Link)

Here is the interface for swapping on Sushi. You can see the Swap displays an option to select the token for ETH. As well as the gas fees with the “gas” icon in green with the current rate.

Up top you have the option to select to Swap, Pool, Migrate, Farm, Lend, Borrow, and Stake. All of these are completely different. (More on this later).

You can engage in any of those once you connect your wallet. An easy wallet to start with is a MetaMask Wallet.

Conclusion

There are many use cases for both CEXs and DEXs. By getting started I would say the anyone new to crypto will have to start with CEXs. They’re easier to use and will allow you to build up your holdings while you learn more about DEXs and become more comfortable using them. Be sure to have some ETH so you can use the DEX.

I appreciate the patience waiting for this new post. Just started a new role in tech sales.

My next post is going to be a deeper dive into DEXs and how to use them. I wanted to start an introduction into this by giving you a side by side analysis first.

As always, thanks for reading! Share with any friends and family so they can learn more about crypto.

Sign up for my CBDC Newsletter👇

Disclosure: Not financial or legal advice

Thanks for the great post! I’ve been using CEXs until now and look forward to your future posts on how to use DEXs. I’d been interested to learn how to initially purchase ETH without buying it on a CEX (I.e., buy ETH without KYC).

Created a MetaMask account and went to buy ETH but (1) the limits are really low and (2) the fees are really high (especially in light of (1)). Is this common?