Introduction

This is a post that involved a collaboration with BowTiedAss [Twitter Link] (Anonymous crypto user working to simplify decentralized finance for the layman → Medium Website)

The purpose of this post is to simplify and ease you into DeFi.

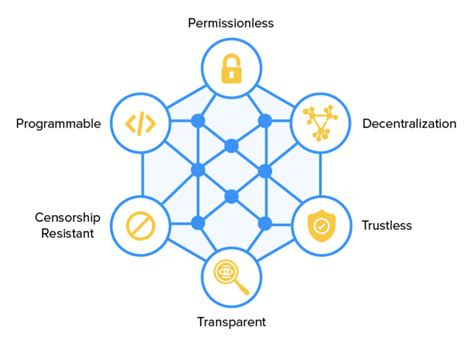

In its fundamental nature, Decentralized Finance (DeFi) is the replacement of financial intermediaries by decentralized applications (Dapps). It is an alternative to the current financial system → DeFi is replacing the “legacy” financial system through smart contracts on the blockchain → through *code*.

The legacy financial system’s products are not open source and transparent like they are in DeFi. We know this because DeFi is ran on blockchain technology and leaves it open for anyone to use.

Code programmers who are writing these smart contracts provide the production of these Dapps. We know from the last issue that Ethereum is the “world’s programmable blockchain” that enables the production of these Dapps. So, it is no surprise that currently *most* DeFi applications and projects are ran on Ethereum. Ethereum Dapps turns all of this into “programmable money”.

These Dapps are products and services that do the same things you would in the traditional financial system.

They let you: save, borrow, earn, trade, and more.

Except it is open and free to use since it is ran on *open source technology*. It is built for the internet, which is all you need to participate in DeFi.

DeFi Basics

The foundation of Decentralized Finance is built off of three pieces of technology: cryptography, blockchain and smart contracts.

Cryptography is the use of written code to secure communication between two people in the presence of third parties. It secures information (data transfers) in the presence of adversaries. Concerning your crypto assets this protects your wallet, assets, and transactions. This enables the transfer of those assets and/or information without intermediaries, like banks.

Blockchain is technology that collects information in sets or *blocks* that are then connected cryptographically. The result is that nothing be changed or corrupted. The information cannot be changed or modified making it → immutable.

Think of it as a public record of data stored in chronological order. The blockchain is shared between all users. As new data comes in it is entered into a fresh block. Once the block is filled with data it is chained onto the previous block.

Smart Contract: a self-executing contract with the *terms* of the contract being written directly into code. All of the information in the contract resides at a specified address for specified purposes (bets, purchases, etc.). It's a collection of code (its functions) and data that resides at a specific address on the Ethereum blockchain.

Think of smart contracts as a type of account. This means they have a balance and they can send transactions over the network. However they're not controlled by a user, instead they are deployed to the network and run as programmed.

How Decentralized Finance Makes Money

Decentralized finance makes money by replacing intermediaries with code. The premiums that banks and financiers earn by lending money, or being market makers, are available to anyone now that we have DeFi and can do this ourselves. Smart contracts and well-designed DeFi protocols allow many people to aggregate their capital and act as the collective middle man. Fees earned are then divided *proportionally between all participants*.

Additionally, DeFi protocols have their own native tokens. These tokens can give their holders claim to a percentage of revenue generated by protocol or allow the holders the ability to decide the future of the protocol.

There are three main ways that investing in decentralized finance makes you money:

Lending/Borrowing

Providing Liquidity

Value Appreciation

Its important to understand all three ways of earning a return. Each way has a place in a well-rounded DeFi investing strategy.

Lending/Borrowing

This first way to make money with DeFi, lending and borrowing. Lending is trading money today for a repayment of the principle plus the additional interest, allowing YOU to be the one earning the *yield*.

Protocols that allow lending and borrowing require collateral to be supplied by the borrower. The borrowers collateral becomes locked into the protocol and is not released until the borrower pays back what they borrow plus the interest. If the amount of interest they owe grows to a certain point, their collateral is released to the lender(s).

Did you think that lending out assets was the only way to make money? You are mistaken! Some protocols reward people for borrowing assets on them. This usually only occurs with new protocols (or new smart contract platforms) which try to attract use by offering rewards for all transactions on them. Up until recently, BowTiedAss got paid to borrow on AAVE using the Polygon network. While he owed ~3% on what he borrowed, he was paid ~5% in MATIC token. → This is called arbitrage.

(I’ll cover more on that later.)

The biggest protocols for Lending/Borrowing are Compound and AAVE. Decentralized Exchanges are marketplaces for the trade of goods services and financial instruments. Historically, for exchanges to be efficient they have required a "market maker" or third party to be there providing liquidity and allowing smaller players to quickly exchange one good or service for another. Market makers pocket the spread between what the smaller players buy and sell.

Cryptocurrency has several large centralized exchanges including Coinbase, Binance, Gemini, and Kucoin. They are both the intermediaries and custodians of crypto assets listed on their exchange. People that trade on these exchanges do not have complete control of their assets. Thereby leaving their crypto (their assets) at risk if the exchanges get hacked, or can’t repay their obligations (Mt. Gox).

Leaving your coins on these exchanges leaves them open to hacks or being seized by outside authorities. Many people have learned the hard way,

***Not your Keys, Not your Coins***

Click on both links to see the simpler hardware wallets to set up ( Trezor, Ledger )

Providing Liquidity

A decentralized exchanges or (DEX) allow people to exchange assets without giving up control of their keys. Decentralized exchanges (DEXes) do not have a centralized body providing liquidity, they use liquidity pools.

Liquidity Pool: A liquidity pool is a large decentralized pool of assets acts that acts as the market maker instead of a single person, company or institution.

This works by using smart contracts to regulate a pairings of assets. Owners of assets transfer their assets to a protocol and receive Liquidity Protocol or "LP tokens” of that protocol in return.

When someone uses a DEX to exchange their cryptocurrency for another, they pay a fee of approximately 0.3%.

LP tokens can be redeemed at any time for a proportional amount of the underlying pairing which includes what was deposited and a proportional amount of the collected fees. Much like new lending protocols sweetening the deal with extra rewards, DEXes can give extra rewards in order to attract more capital. Every DEX is different, but the extra rewards are paid in the DEX’s native token and CAN represent a good amount of your return.

Popular DEXes are:

Uniswap (←Link)

Curve (←Link)

SUSHI (←Link)

Value Appreciation

The final way to earn money with DeFi is just the appreciation of the protocol's native token.

This occurs over the long term if the protocol is healthy, maintains a high Total Value Locked (TVL) and consistently makes money. Native token's can do many things including giving their holders the right to vote on governance of the protocol or access to special rewards.

It is important to be aware how these tokens have been distributed. If a large percentage are controlled by a small number of people, or if the supply is rapidly increasing because of rewards, the token can be subject to inflation and the value can collapse.

Other Key Catagories of DeFi

Stablecoins

These are pegged to other “stableassets” were created. These are subject to the same static value of the asset they are pegged against. Also, the same level of debasement. Tether (USDT) is one of the first stablecoins to be introduced to the world of crypto.

Derivatives

A derivative is a contract where the value is “derived” from another underlying asset, a “derivation”. Traders can use this to hedge their position to either increase or decrease risk.

Fund Management

You can find an example of this in Balancer, a DeFi protocol that uses algorithmic management. It manages your assets to optimize “balance” in your crypto portfolio. It always maintains a particular level of allocation by constantly rebalancing each crypto asset to optimize your fund.

Government

Governance in the sense of crypto means that governance tokens enable the management of the protocol to ensure the users have a say, or a “vote”. It’s another version where some Dapps help facilitate user’s voices for the roadmap of the protocol.

Payments

DeFi enables quick, frictionless, trustless, and creative payment methods. This is one of the key roles that smart contracts will play.

“User accounts can then interact with a smart contract by submitting transactions that execute a function defined on the smart contract. Smart contracts can define rules, like a regular contract, and automatically enforce them via the code. Smart contracts can not be deleted by default, and interactions with them are irreversible.” (Ethereum.org)

Conclusion

Through careful planning traditional financial services that require an intermediary, or centralized authority to execute, can be done via smart contracts. The technology is in its infancy but also has seen rapid growth over the last year. This is an important space to keep up with, as it will only continue to grow as it sucks capital away from traditional financial companies and institutions.

It was a pleasure to partner up with BowTiedAss for this posting. I look forward to many more publications together.

Thank you for reading. Share with your friends!

Disclaimer: None of this is to be deemed legal or financial advice.